I need your help. If you have any experience owning vacation rental properties, especially in seasonal areas or foreign countries, I’d love to hear your thoughts! I’ve never owned income property before, but I see others who have and for whom it’s working out very well as a way to partially fund my life in the future. So I’m here in Costa Rica looking at properties and found one that is very intriguing. I know there are a ton of details I need to work out, but here are the particulars.

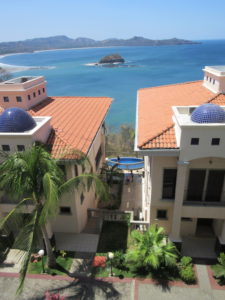

First, the pictures….

2 Bedroom, 2.5 bath condo in a new but fully built building with 16 units, in Playa Flamingo, which is a seaside village on the northwest Pacific coast in the Guanacaste district of Costa Rica. Two new finished units are for sale.

Playa Flamingo (map, overview use Chrome automatic translation if you can’t read Spanish) has a long history of ex pats living or vacationing here. Within 5 minutes of the property, there is a cute little village with nice restaurants, resorts and beaches. Good surfing and scuba diving too. Some really expensive houses (think multimillion) up in the hills of Playa Flamingo. An international airport with the confusing name of “Liberia” is just 45 minutes away. I flew into it from LAX, nonstop, Alaskan Airlines, $174 one way.

The property sits atop a hill overlooking the Pacific. This part of Costa Rica has a dry season (now) and a wet season (June-Aug). If you’re unfamiliar with Costa Rica, check out these articles: this, this and this. Seems the majority of the tourists I’ve met in my first week here are not from the US, most from Europe, Canada, and South America.

I haven’t done due diligence yet but this is what I got from the listing agent and my buyers agent.

Price: $235,000 unfurnished. Add $15,000-$20,000 to furnish completely.

Private financing from the builder available at 5.25%. Minimum down payment is $100,000, leaving about a $750 / month mortgage payment.

Rentals in the rest of the building run around 50% of the year, at around $200-$250 per night. (So…$200 *180=$36,000 total revenue per year). Plus, of course, I get to live in it or offer it to family and friends any other time.

HOA fees, including security, garbage, landscaping, maintenance = $410 / month. Property Management fees about $110 / month plus 20% of rental revenue they bring in, and 10% if I bring the renters.

Internet/Cable is $70 / month with 20Mbps download and 5Mbps upload.

Not sure about electricity, but I noticed that even at 90 degrees, the winds through the open windows (no bugs!) kept the place very comfortable without A/C.

Key for Dave: It. Never. Gets. Cold.

Listing agent claims that, paying all cash, with all expenses, the place would likely return 6.5% per year, based on what the other units are making after 2 years. Clearly, I’d need to do my own due diligence on this.

So…key question for you.

- If you have experience with income properties, can you point me to books, tools (like spreadsheets) or courses that you have found useful?

- If you have no experience, and are also looking into investing in income properties, or want to know more about it, do you want to stay in touch with me while I look into this? Maybe, to put a little skin in the game, you could also provide what you’re learning about.

- If you are really curious, I’m open to taking on a partner or two to share in this investment opportunity. Let me know if you’re interested in that.

In any case, it looks like the cost of living in Costa Rica is a whole lot less than California. With better views!